Investments

Book Appointment

Investment Strategy & Services

Our clients want to grow their investments over the medium to long term, use them to generate an income they can live on and protect their wealth from being diminished by inflation or taxes. It’s never too soon to start investing, and it’s never too soon to start learning about investing. It is often said that time in the market is more important than timing in the market, and the odds are certainly on your side the sooner you start to invest.

Investing through a tax-efficient wrapper maximises the returns for you and your family. We take the time to build a comprehensive understanding of your individual circumstances, and your tax position forms part of this. We will always look to ensure that you are taking advantage of all relevant tax allowances when helping to structure your finances and manage your investment portfolio.

Two of the most commonly used wrappers are ISAs (Individual savings Accounts) and Pensions.

Investments vs Savings

Depositing cash in a savings account often appears to be the safest option for your money. However, over time the impact of inflation (a measure of the increase in cost of goods and services over time) can mean that despite the interest earned on the cash you have deposited, its real value in terms of purchasing power can gradually decrease.

The benefits of long-term investing

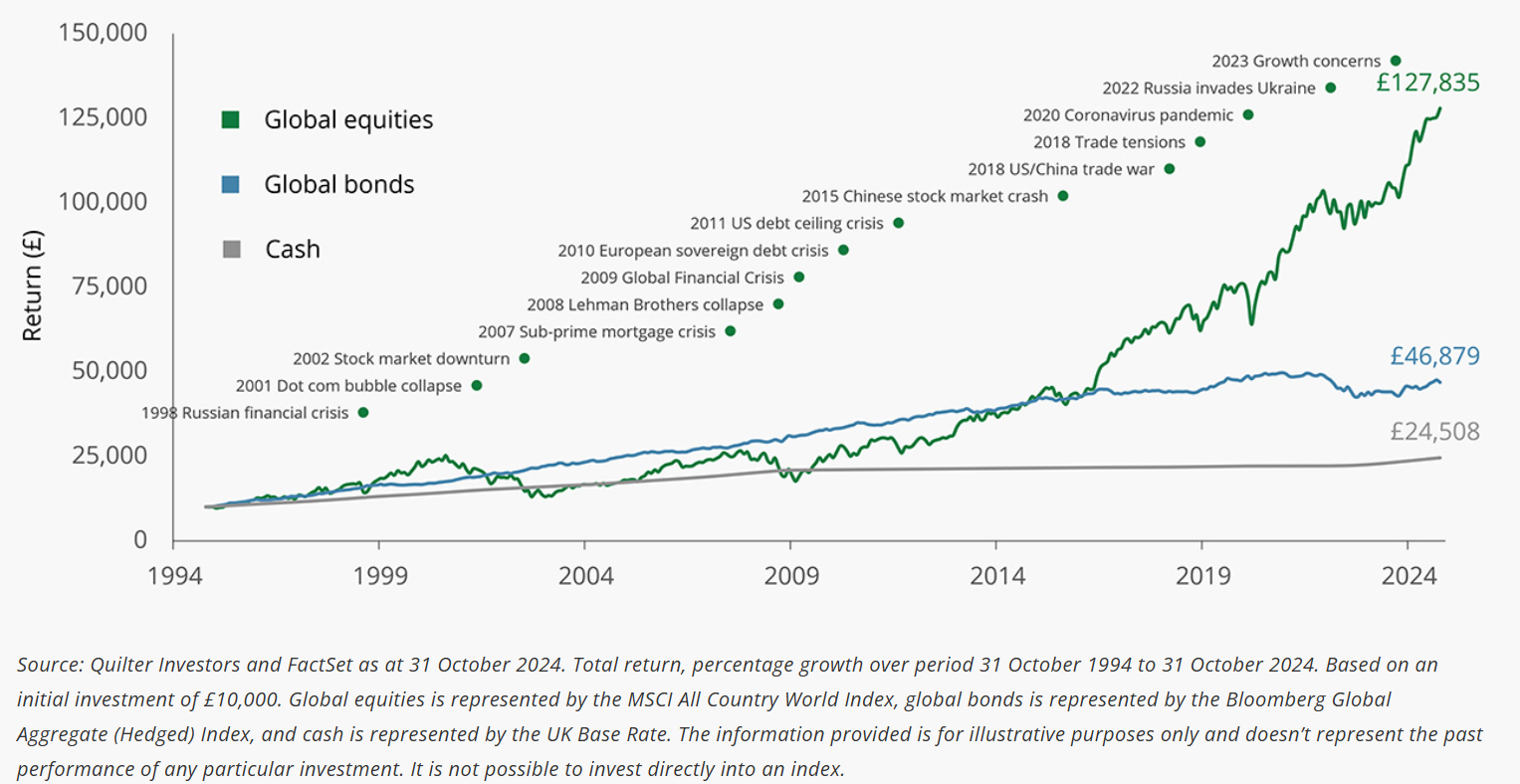

The chart below shows that over the long term, there is an upward trend of returns from equities and bonds, despite the short-term volatility caused by major events. In fact, a £10,000 investment into global equities in 1994 could have grown to be worth £127,835 today. This is nearly three times more than bonds (£46,879) and over five times more than cash (£24,508).

Source:

While it should always be remembered that the return on any investment cannot be guaranteed, a properly diversified portfolio comprising equities, bonds and other assets is likely to give you the best chance of beating inflation and providing a strong return while managing risk.”

Tax-Efficient Investing

It is important to protect your investments from unintended taxes, which may seriously erode their value over time. To do this we will use a ‘tax wrapper’. This is an account which ensures you do not pay tax on interest, income or capital gains on your investments up to a certain limit.

Investments

Investing for income

Some of our clients invest their money to generate an income. They may want extra cash to enjoy during retirement, support a child at university or to help pay off a mortgage. After carefully understanding your needs, we will tailor an investment portfolio to help achieve your goals.

Investing for growth

Some of our clients invest their money for growth. They may want to grow their wealth to buy a property, cover school fees or generate capital to enjoy later in life. After carefully understanding your needs, we will tailor an investment plan to achieve your goals.

Investing for income and growth

Some of our clients want to grow their wealth and generate an income at the same time. After carefully understanding your needs, we will tailor an investment portfolio to achieve these two goals.

ISA

Holding a proportion of your portfolio in an Individual Savings Account (ISA) is a particularly tax-efficient way to invest.

Types of ISA

• Cash ISA: A straightforward savings account which is exempt from tax on interest. Some allow instant access and some are fixed term - the interest rate will generally vary with the length of the term.

• Stocks & Shares ISA: Stocks & Shares ISAs are exempt from tax on interest, income or capital gains tax and are usually invested in equities, bonds or investment funds.

• Junior ISAs: To give young savers a headstart, the Junior ISA allows you to save or invest for your child or grandchild tax free. Again this can be in the form of cash or stocks & shares.

For ISA’s Investors do not pay any personal tax on income or gains, but ISAs may pay unrecoverable tax on income from stocks and shares received by the ISA managers.

Offshore Bonds

Bonds invested in overseas jurisdictions, which are not subject to tax until brought back onshore. These can also limit your exposure to tax. As with ISAs, there are tax benefits to including offshore bonds in your investment portfolio.

A UK bond is a loan to a company or government (a "gilt") which, in return, provides a fixed rate of interest. By contrast, an offshore bond is not taxed locally, so over the long term investors can benefit from compounded income and gains. Income within the bond will only be subject to tax upon encashment of the bond.

The value of pensions and investments and the income they produce can fall as well as rise, you may get back less than you invested.

Tax treatment varies according to individual circumstance and is subject to change.